Remediation programme delivers to UK bank under FCA deadline

Our client case study outlines how the large-scale assignment of FDM Consultants eliminated a client’s high-risk backlog ahead of schedule

Trusted by over 300 clients worldwide

Discover how we’ve helped businesses like yours grow, scale and develop by exploring all our client case studies. Add your details below to get started.

- Discover

-

Understanding the challenge

Since 2008’s financial crisis, the financial services industry has faced enforced regulations. These included the Dodd-Frank Act, Fair and Accurate Credit Transactions Act and Know Your Client (KYC).

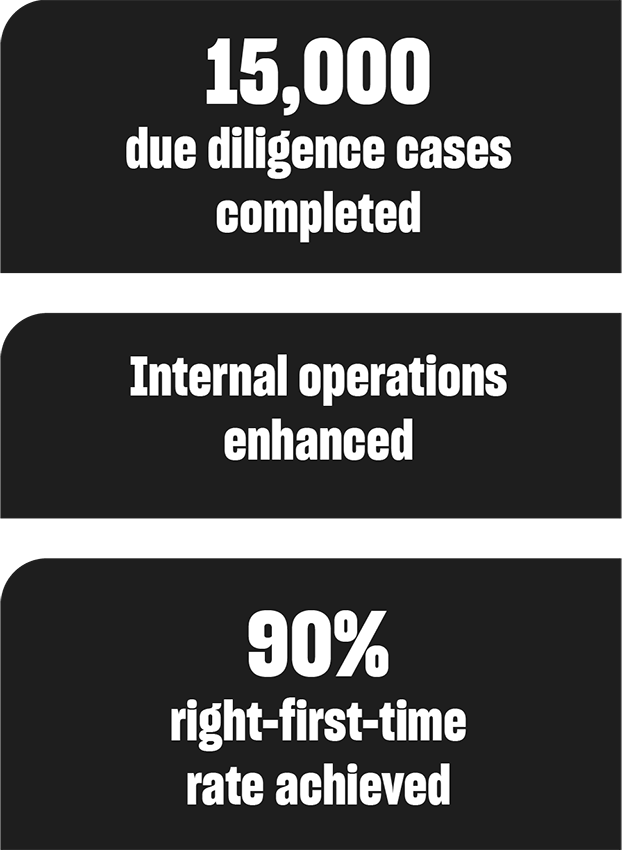

To comply, the bank required a thorough review to identify changes, update customer information and assess risk levels. We initiated a high-level discovery session to assess the scope of work: refreshing a population of 15,000 customer due diligence cases.

Our analysis within their operations identified financial crime risk ranging from an absent data audit trail, causing communication disruption, to documentation gaps on niche aspects of due diligence.Through collaboration we determined the customer entities to be worked on and team competencies required in risk assessment and regulation compliance. Establishing performance expectations, we customised training for new consultants to meet necessary standards.

- Design

-

Full team talent spectrum

FDM had an existing team of consultants with Risk, Regulation & Compliance (RRC) skills, varying from experienced to recently trained in practical KYC. Our Skills Lab provides expertise ideal for the project’s requirements, such as proactive risk identification, assessment and mitigation.

On assessing the operation’s scale, team leads and quality control consultants were assigned in addition to quality makers. In a new development, FDM staff performance monitoring would be a co-shared responsibility, enhancing job oversight.

The scope of work for execution was split into two different business segmentations: small to medium sized enterprises, or SME, and non-SME, or enterprise level.

Consultants’ KPIs for enterprise level was a run rate of 6 cases per head per month. For SME, a target of one case per day.

- Deliver

-

Rapid response to evolving needs

The RRC Practice deployed 85 consultants, with FDM analysts improving collaboration and governance across all levels.

Improved procedures and results

Our consultants optimised the client’s methodology to better identify operational gaps between the first line and second line and trends based on executed data, leading to:

- Improved data quality and risk categorisation

- Effective resource allocation and coaching

Data analysis revealed customer environment gaps, enabling re-categorisation of medium and low-risk populations to high risk. This led to targeted coaching and faster batch disposal.

Tracked data with enhanced checking led to:

- Precise coaching levels needed for faster success

- 50 additional checkers within six months

- Establishing a standardised support structure across all levels

Escalating achievements

We further improved governance with an escalation and deviation process to better address data gaps, helping correct numbers and achieve targets faster.

- Consultants proactively devised more robust standard operational procedures, helping streamline case management to significantly reduce out of tolerance cases.

- Case quality increased: 75% right-first-time rate by month four and, by month six, the team was consistently hitting 90%.

- Our consultants routinely tracked ahead of the banking forecast, completing over 50% of cases by mid-project and growing to 64 completions ahead.

Unprecedented outcome

FDM’s remediation successfully eliminated the client’s high-risk backlog prior to the FCA deadline.

Our learnings led to a fundamental programme shift focused on conduct, governance and best practices to help reshape consultant development. Our model office bank, an experiential applied training and pre-assignment construct, was built to replicate this success at scale.

A zero consultant attrition rate reflects the strong client partnership.

We create customised solutions to meet your unique organisational needs

We’re trusted by over

300 companies worldwide